Top Mutual Fund Trends for Smart Investing in 2025

Investing in mutual funds can be simple, but staying updated with mutual fund trends 2025 is key to getting ahead. In today’s dynamic markets, knowing what is popular – and why – can help young professionals make informed choices. In this post, we will explore the top trends for 2025: the rise of thematic/sectoral funds (think AI, green energy, EVs), the growing appeal of passive index funds and ETFs, the traction of dynamic asset allocation funds, the push for global diversification, and the surge in disciplined SIP investing. Each section explains the trend in plain language, with examples and practical tips to align your strategy.

Ready to learn how to invest smart? Let’s dive in.

1. The Rise of Sectoral & Thematic Funds

Thematic or sectoral funds target specific industries or trends – for example, funds focused on electric vehicles, artificial intelligence, or renewable energy. In 2024 these funds saw huge inflows: investors put about ₹1.40 lakh crore into sectoral/thematic funds, up from only ₹30,840 crore in 2023. Sectors like manufacturing, healthcare, infrastructure and especially green energy and technology attracted most of this money. m.economictimes.com, livemint.com.

Investors like these funds because they can ride big trends. For instance, a young investor excited about EVs might choose an auto-sector fund to gain exposure to companies like Tesla or Tata Motors. However, this focus comes with risk: if that sector falters, the fund’s value can drop sharply. Experts caution that no single sector keeps booming forever.

Tip: If you invest in thematic funds, do so cautiously. Treat them as a small part of your portfolio. Research the theme you believe in (say, clean energy or fintech) and only invest what you can afford to risk. Diversify by choosing funds in different themes or balancing them with broad funds. For example, instead of putting everything in a single tech fund, also keep some money in a large-cap fund or ETF.

2. Passive Investing: Index Funds & ETFs Gain Steam

Passive funds – like index funds and ETFs – continue to grow in popularity. These funds simply track a market index (for example, Nifty 50 or S&P 500) rather than picking individual stocks. That means lower costs (no big management fees) and fewer surprises. In 2024 alone, India’s passive fund AUM jumped 1.5 times, from ₹7 lakh crore to over ₹11 lakh crore by September. Nearly half of the passive fund investors are Millennials and Gen Z – folks like you who appreciate simplicity and cost-efficiency.

Why are passive funds trending? A few reasons: investors have become more price-conscious, and technology makes it easy to invest. Also, when markets rise, many passive funds match the market’s performance automatically. For example, a Nifty 50 ETF will generally rise (or fall) roughly with the Indian market. This approach often beats the average active fund after fees. Globally, trends are similar – think of how index funds dominate the US market.

Tip: Consider making index funds or ETFs a core part of your portfolio. They offer market diversification at low cost. Compare expense ratios (lower is better) and pick broad indices. For Indian investors, a Nifty or Sensex index fund is a good start; you might also explore global ETFs that track foreign markets like the Nasdaq or S&P 500 (for exposure to tech giants abroad). Because these funds move with the entire market, they’re great for long-term, “set and forget” investing.

3. Dynamic Asset Allocation Funds

Another growing trend in 2024–25 is Dynamic Asset Allocation (DAA) funds, also known as balanced advantage funds. These funds automatically shift their investments between equity and debt based on market conditions. If the stock market looks overvalued, the fund might switch more into bonds; if equity looks cheap, it increases stock exposure.

This dynamic strategy has drawn attention because it can potentially smooth returns. In fact, in 2024 many balanced advantage funds delivered strong returns (up to 20% in some cases) while keeping risk moderate. For example, the Quant Dynamic Asset Allocation Fund delivered about 20.15% return in 2024, with category average around 12.8%. These funds can provide growth when markets rise, and some protection when markets dip.

Tip: DAA funds are useful if you want a mix of growth and safety without constantly rebalancing yourself. Treat them as a core part of a medium-risk portfolio. Just like any fund, look at past performance and the fund manager’s strategy. A balanced advantage fund can help ride volatility: as one advisor noted, these funds perform well during downswings because they adjust away from stocks. Start with a small SIP in one or two such funds to experience their cycle-based approach.

4. Global Diversification: International Funds

2025 is seeing more investors look beyond their home markets. With global tech stocks, green energy, healthcare and other sectors booming, many young Indians are exploring international mutual funds. These funds invest overseas (often in the US or other developed markets) to diversify away from domestic risk. For instance, if trade tensions or economic cycles hit the Indian market, global funds can buffer your portfolio with different trends.

Business Today reports that Indian investors are increasingly tapping international funds to protect against domestic volatility. These funds expose you to different currencies too, which can be an advantage if the rupee weakens. Popular choices include India-based funds that track US indices (like S&P 500 or Nasdaq 100) or specific sectors globally (like biotech or clean energy). Keep in mind though, global markets have their own ups and downs, and currency changes affect returns.

Tip: Don’t ignore global opportunities. You might allocate 5–15% of your portfolio to international funds to smooth overall returns. For example, a US index fund or a global tech fund can complement your India-heavy holdings. When choosing, read the fund’s strategy: some funds hedge currency risk, others don’t. Also, check expense ratios and invest through reputable AMCs. Over time, this geographical mix can boost returns and reduce risk.

5. SIPs & Disciplined Investing

One of the heartening trends is the rise of Systematic Investment Plans (SIPs) and overall disciplined investing. SIPs let you invest a fixed sum (say ₹5,000) every month into a mutual fund. This automates saving and benefits from rupee-cost averaging. In FY2025 (April 2024 – March 2025), SIP inflows in India shot up ~45% to about ₹2.9 lakh crore, the fastest growth in years. The average monthly SIP contribution also climbed from ₹16,602 crore to ₹24,113 crore.

What does this mean? More young people are making saving a habit. SIP investors stayed committed even when markets wobbled, highlighting growing financial maturity. If you start early and stay invested, compounding can work wonders. For example, a modest ₹5,000 monthly SIP investing in a diversified equity fund over 10 years can grow substantially thanks to regular compounding and averaging.

Tip: If you haven’t already, start a SIP today, even if the amount is small. Automate it from your salary account so it happens without thinking. Treat SIPs like a recurring bill payment; this “pay yourself first” approach builds discipline. You can increase the SIP amount as your salary grows. And remember, SIPs aren’t only for equities; you can do them in debt funds or balanced funds too, depending on your goals.

Actionable Tips for Smart Investing in 2025

Diversify across trends: While thematic and sector funds can boost returns, balance them with broad market funds. For example, if you invest in an EV-themed fund, also keep some money in a broad large-cap fund or a stable index ETF.

Mix passive and active: Use index funds/ETFs as the backbone of your portfolio (for example, 40–60%), and devote the rest to carefully picked active or thematic funds where you see potential.

Add a DAA or balanced fund: Since markets can swing, including a dynamic asset allocation fund can automatically adjust your equity-debt mix and reduce risk.

Think globally: Consider allocating a small portion (5–10%) to international funds to capture global growth. For instance, a fund that tracks the Nasdaq or a world index.

Stay disciplined with SIPs: Keep up your SIPs every month. Set up reminders or automate to avoid missing contributions. Small investments add up over time.

Do your homework: Before investing in any fund, read its fact sheet or scheme information. Understand the expenses and the sector it invests in. Don’t chase past performance blindly.

Watch costs: Lower expense ratios (fees) can significantly boost your long-term returns, especially for passive funds.

Stay flexible: Trends change. If a once-hot sector is now struggling, be prepared to exit. Follow updates from reliable sources (like this blog).

Emergency fund first: Before making big bets, ensure you have 6–12 months of expenses saved. Check out our guide How to Build an Emergency Fund for tips.

By aligning your strategy with these trends (while staying true to your goals and risk comfort), you will be better positioned to grow your wealth in 2025 and beyond.

Keep in mind that all investing involves risk. Past trends are not guarantees of future results. Always consider consulting a financial advisor.

Recent Posts

Related Articles

India’s 2025 Economic Boom: Smart Investment Ideas For Young Investors

As reported in recent business news, India is experiencing a remarkable surge...

ByMySmartGrowthTeamJuly 26, 2025Jio BlackRock – The Game Changer for Indian Wealth Investing

Jio BlackRock Enters India: What It Means for Investors in 2025 Indian...

ByMySmartGrowthTeamJune 8, 2025What is the Stock Market? A Beginner’s Guide…

What is the Stock Market? A Beginner’s Guide to How it Works...

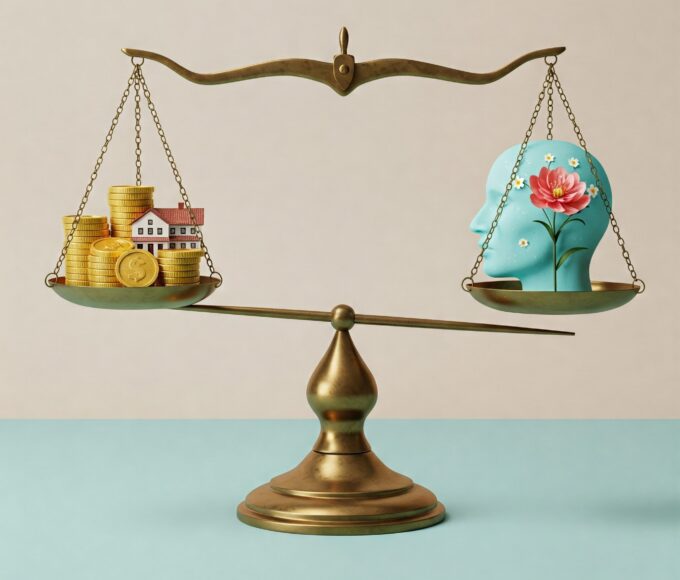

ByMySmartGrowthTeamApril 8, 2025Financial Wellness in 2025: Balancing Money, Wealth and Mental Health

In today’s fast-paced world, financial stress is a major contributor to mental...

ByMySmartGrowthTeamMarch 30, 2025

Leave a comment