Best Budgeting Apps for Indian Millennials in 2025

Best Budgeting Apps for Indian Millennials in 2025: Master Your Money with Ease

In today’s fast-changing financial landscape, Indian Millennials are increasingly looking for smart, tech-driven ways to manage their money. Rising living costs, fluctuating incomes, and the demand for financial independence have driven the popularity of budgeting apps. These digital tools help you track your expenses, set financial goals, and ultimately master your money with ease. In this comprehensive guide, we’ll explore the best budgeting apps for Indian Millennials in 2025, share key features, and explain why using these apps can transform your financial future.

Why Budgeting Apps Matter for Indian Millennials

- Digital-First Generation : Millennials are tech-savvy and prefer managing finances on the go. Budgeting apps provide the convenience of tracking expenses, monitoring cash flow, and setting savings goals from your smartphone.

- Rising Living Costs : With inflation and increasing urban expenses, it’s more important than ever to maintain a clear picture of your spending and savings. Budgeting apps help you stay on top of your finances and avoid overspending

- Financial Empowerment : These apps not only track your expenses but also provide insights and analytics to improve your money management skills. Over time, this leads to better financial decisions and a robust savings plan.

- Goal-oriented investing : Budgeting apps allow you to set goals—whether saving for a dream vacation, buying a home, or building an emergency fund—ensuring you remain focused on your long-term objectives.

Best Budgeting Apps for Indian Millennials in 2025

After extensive research and analysis of user reviews, features, and performance, here are the best budgeting apps that are making waves in India this year:

1. AXIO

Key Features:

- Expense Tracking: Automatically categorizes your expenses by scanning SMS alerts from banks.

- Bill Reminders: Never miss a payment with timely reminders.

- Data Visualization: Interactive charts and graphs for better financial insights.

Why It Stands Out:

axio is popular for its simplicity and efficiency in tracking day-to-day expenses. It is particularly well-suited for those new to digital budgeting.

2. ETMoney

Key Features:

- Investment Tracking: Manage mutual funds, SIPs, and other investments alongside expenses.

- Goal Setting: Set financial goals and track progress over time.

- Tax Planning: Built-in tools for calculating tax savings and planning investments accordingly.

Why It Stands Out:

ETMoney offers a holistic view of your finances by combining budgeting with investment and tax planning, making it a one-stop solution for comprehensive money management.

3. Money Manager

Key Features:

- User-Friendly Interface: Simple design ideal for beginners.

- Custom Categories: Personalize your expense categories to suit your spending habits.

- Reports & Analytics: Detailed monthly and yearly expense reports.

Why It Stands Out:

Money Manager is lauded for its intuitive interface and customization options, enabling users to tailor the app to their specific financial needs.

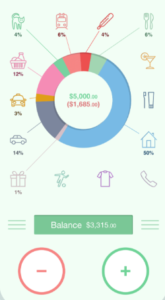

4. Monefy

Key Features:

- Easy Data Entry: Quick expense tracking with a user-friendly interface.

- Sync Across Devices: Cloud sync functionality to keep your data up to date on multiple devices.

- Budget Visualization: Graphical representations of income versus expenses.

Why It Stands Out:

Monefy is great for users who want a straightforward, hassle-free way to log expenses and monitor their budgets without too many complex features.

![]()

5. Goodbudget

Key Features:

- Envelope Budgeting System: Allocate funds to virtual envelopes for various expense categories.

- Family Sharing: Share your budget with family members to track collective expenses.

- Expense Forecasting: Plan for future expenses based on historical spending.

Why It Stands Out:

Goodbudget’s envelope system is particularly effective for those who prefer a visual, planned approach to budgeting. It’s ideal for households looking to manage group finances collaboratively.

6. Expense Manager

Key Features:

- Detailed Logging: Record every transaction with notes and tags.

- Budget Alerts: Set thresholds for different spending categories and get notified when you’re close to your limit.

- Custom Reports: Generate customized reports to analyze your spending trends.

Why It Stands Out:

Expense Manager offers a high level of detail and customization, which is perfect for professionals who want to drill down into their spending habits.

![]()

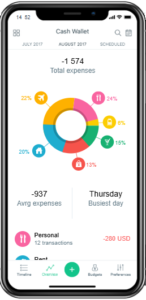

7. Spendee

Key Features:

- Automatic Bank Sync: Link your bank accounts for real-time expense tracking.

- Shared Wallets: Create shared budgets with friends or family.

- Budgeting Insights: Advanced analytics that offer insights into spending patterns.

Why It Stands Out:

Spendee is recognized for its seamless bank integration and robust analytics, making it an excellent choice for users who want to manage both personal and shared finances efficiently.

8. BudgetBakers (Goodbudget Alternative)

Key Features:

- Envelope Budgeting: Similar to Goodbudget, it uses the envelope system for budgeting.

- Cross-Platform Sync: Sync your data across devices, making it convenient for on-the-go budgeting.

- Customizable Categories: Personalize budgeting envelopes to match your unique spending patterns.

Why It Stands Out:

BudgetBakers offers similar benefits to Goodbudget with enhanced cross-platform features, making it a robust alternative for tech-savvy users.

How to Choose the Right Budgeting App

While each app has its unique features, here are some factors to consider when selecting the perfect budgeting tool for your needs:

- Ease of Use: Choose an app with a simple, intuitive interface that you can use daily without hassle.

- Integration: Look for apps that can sync with your bank accounts or other financial tools for real-time updates.

- Customization: Consider apps that allow you to set custom categories and budgeting envelopes to reflect your personal financial habits.

- Analytics: The best apps provide detailed reports and visual insights to help you understand and control your spending.

- Security: Ensure the app uses robust encryption and data protection protocols to secure your financial data.

Benefits of Using Budgeting Apps

Budgeting apps offer numerous benefits that go beyond simple expense tracking:

- Better Financial Awareness: By monitoring your income and spending, you become more aware of your financial habits and can make more informed decisions.

- Reduced Overspending: Alerts and notifications help you stay within budget and avoid unnecessary expenses.

- Goal Tracking: Visual progress indicators keep you motivated as you work towards your financial targets.

- Time-Saving: Automating routine financial tasks lets you focus on strategic planning and investments.

- Enhanced Savings: Consistent tracking helps you identify areas where you can cut back and save more money.

Tips for Maximizing Your Budgeting App Experience

- Set Realistic Goals: Start by setting achievable financial targets, whether it’s saving a specific amount or reducing unnecessary expenses.

- Review Your Budget Regularly: Revisit your app weekly or monthly to track progress and adjust your spending habits as needed.

- Use Notifications: Enable alerts for bill payments, budget limits, and savings milestones to stay on track.

- Link Your Accounts: Where possible, sync your bank accounts, credit cards, and other financial tools for real-time updates.

- Leverage Insights: Use the data and reports provided by the app to analyze trends and improve your budgeting strategy.

Final Thoughts

For Indian millennials in 2025, managing finances effectively is the key to achieving financial independence. With a myriad of budgeting apps available, you have the tools to transform your financial habits, save more, and invest wisely. By choosing the right app tailored to your lifestyle, you can gain control over your expenses, set and achieve your financial goals, and ultimately master your money.

Whether you opt for the simplicity of Axio, the comprehensive features of ETMoney, or the intuitive interface of Spendee, the right budgeting app can be a game-changer. Start exploring these top options today and take your financial management to the next level!

Frequently Asked Questions (FAQs)

Q1: What is the best budgeting app for Indian millennials in 2025?

A1: The best app depends on your needs. Axio and ETMoney are popular choices for their ease of use and comprehensive features.

Q2: Are these apps secure for managing personal finances?

A2: Yes, reputable apps like Monefy and Spendee use robust encryption and security protocols.

Q3: Can budgeting apps help me save money?

A3: Absolutely! They help track your expenses, set savings goals, and provide insights into spending patterns, enabling you to save more efficiently.

Recent Posts

Related Articles

How to Invest in Real Estate Crowdfunding in India: Your 2025 Guide to Smart Property Investment

In an era when traditional real estate investments require hefty capital and...

ByMySmartGrowthTeamFebruary 21, 2025Rail Vikas Nigam Limited: Past, Present, and Future Prospects for Smart Investors

Rail Vikas Nigam Limited (RVNL) has long been a cornerstone of India’s...

ByMySmartGrowthTeamFebruary 20, 2025DeepSeek AI: The New Frontier in AI-Powered Financial Strategies

In the ever-evolving landscape of artificial intelligence (AI) and finance, a new...

ByMySmartGrowthTeamFebruary 17, 2025Sukanya Samriddhi Yojana (SSY) 2025

Sukanya Samriddhi Yojana (SSY) 2025: A Complete Guide to Secure Your Daughter’s...

ByMySmartGrowthTeamFebruary 16, 2025

Leave a comment