India’s 2025 Economic Boom: Smart Investment Ideas For Young Investors

As reported in recent business news, India is experiencing a remarkable surge in economic momentum in 2025. Sectors like manufacturing, services, infrastructure and tech exports are outperforming expectations. Inflation is cooling, interest rates are stabilizing, and consumer confidence is returning. These are all signals that the Indian growth story is back on track.

But what does this mean for you as the modern Indian investor, professional, or young earner?

Let us break it down in simple terms.

1. Bullish Economy means Bullish Opportunities

With a fast-growing GDP and positive policy support, the stock markets are expected to rally in the coming quarters. This is the perfect time to:

- Start a Systematic Investment Plan (SIP) in equity mutual funds

- Explore ETFs that track Nifty/Sensex

- Consider mid-cap and small-cap funds for long-term growth

2. Infrastructure Push – A Boom for Sectoral Funds

From Vande Bharat trains to highway projects and solar parks, infrastructure spending is skyrocketing.

If you believe in “India Shining,” invest in:

- Infrastructure Mutual Funds

- Construction & PSU sectoral ETFs

These funds benefit directly from government capex plans and large public-private partnerships.

3. Tax Benefits Still Matter

With the Union Budget maintaining its commitment to exemptions for:

- NPS (₹50,000 extra under 80CCD)

- ELSS Funds (under Section 80C)

- Health Insurance (under 80D)

You can save taxes while creating wealth in rising sectors. Perfect time to realign your tax-saving strategy.

4. Rupee Strengthening – A Boon for NRIs and Dollar Earners

As the rupee is projected to stabilize below 82 vs USD, it gives confidence to:

- Foreign Institutional Investors (FIIs)

- NRIs looking to invest in Indian mutual funds and stocks

Start small, build a portfolio in India – the returns may outpace foreign savings accounts or bonds.

5. Golden Era for Young Professionals

If you are a salaried individual in your 20s or 30s:

- Invest in upskilling (AI, FinTech, Data Analytics)

- Use budgeting apps to track your income & savings

- Automate your investments via robo-advisors or apps

Small steps today = Big wealth tomorrow.

Be Part of India’s Financial Revolution

India’s economy is not just reviving but also it is reinventing itself. Whether you are a new investor or a seasoned professional, this is your chance to ride the economic wave.

Start today. Invest wisely. Grow consistently.

Recent Posts

Related Articles

Jio BlackRock – The Game Changer for Indian Wealth Investing

Jio BlackRock Enters India: What It Means for Investors in 2025 Indian...

ByMySmartGrowthTeamJune 8, 2025Top Mutual Fund Trends for Smart Investing in 2025

Investing in mutual funds can be simple, but staying updated with mutual...

ByMySmartGrowthTeamApril 26, 2025What is the Stock Market? A Beginner’s Guide…

What is the Stock Market? A Beginner’s Guide to How it Works...

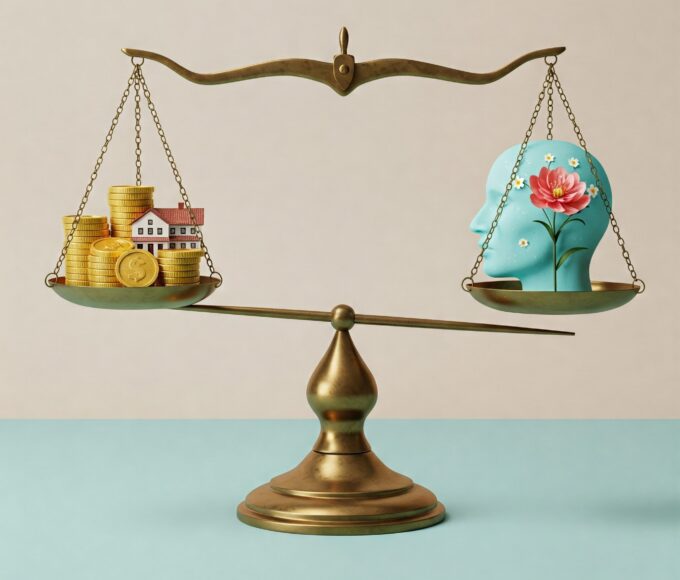

ByMySmartGrowthTeamApril 8, 2025Financial Wellness in 2025: Balancing Money, Wealth and Mental Health

In today’s fast-paced world, financial stress is a major contributor to mental...

ByMySmartGrowthTeamMarch 30, 2025

Leave a comment